CDC Guidelines for prevention of COVID-19 transmission will be followed.

Women And Social Security

“Make Social Security the Cornerstone of your Retirement Plan”

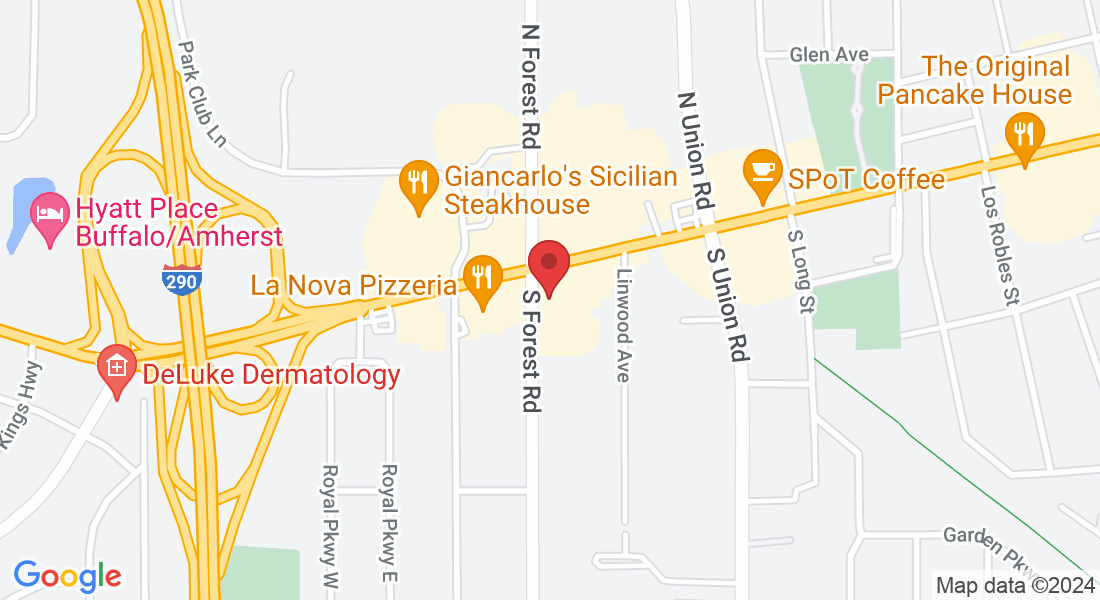

Course Will Be Taught At

The Mosey Hotel

5195 Main Street - Williamsville, NY 14221

This course offers real world strategies and methods designed for those aged 60 and older who are preparing for retirement and want to know more about the Social Security retirement system.

Hosted by The Adult Financial Education Council

Limited Seating

Available

Sign up for our seminar waitlist

And be notified of our upcoming workshops

5195 Main Street

Williamsville, NY 14221

Social Security Educational Course

At The Adult Financial Education Council, we believe if something’s worth doing, it’s worth doing right. When it comes to the nuances of Social Security, learning how to optimize your Social Security benefits goes a long way to helping you live comfortably and confidently.

This 90-minute master class offers real world strategies for those who are preparing for retirement and want to learn how to optimize their Social Security benefits and make their personal savings last.

One of the most important decisions you will be required to make before you retire is when and how to claim Social Security benefits. The majority of retirees apply for benefits as soon as they become eligible, at age 62. For many however, they do so without realizing they are significantly and permanently reducing the benefit amounts they and their spouse will receive throughout their lifetime.

Whether you’re single, married, divorced or widowed, there may be ways to optimize the amount of lifetime, after-tax benefits you and your family receive from Social Security. To do so successfully requires a keen understanding of the Social Security retirement system and the critical issues outlined below:

- How married couples can coordinate benefits to help enhance spousal and survivor benefits.

How to claim a spousal benefit while earning delayed retirement credits on your own benefit.

How the Post Bi-Partisan Budget Act Era, "File and Suspended", "Do over", "Start, Stop, Restart" strategies work.

How working could affect your benefits and the taxability of Social Security benefits.

How claiming worker benefits early could permanently lower your spousal benefit at full retirement age.

- Ways to avoid the dozens of planning traps buried in the nearly 3,000 filing rules of the Social Security retirement system.

This course will address how making sound decisions in these key areas could potentially enhance your retirement income:

Optimizing Social Security benefits

Making informed retirement plan distribution decisions

Creating a "do-it-yourself" personal pension

Understanding how income taxes change in retirement

Here's What You'll Learn

When you are first eligible to collect benefits and how the age at which you apply will affect the monthly amount you receive.

How current employment will impact your ability to collect benefits.

How to coordinate Social Security benefits with pension and IRA assets on a tax efficient basis.

How savvy retirees have increased their annual Social Security benefits by as much as 110%

How cost-of-living adjustments impact benefits.

How spousal, survivor, and divorced spouse benefits work.

When to leverage strategies that will maximize your benefit while collecting from a former spouse.

Ways to optimize your benefit while collecting a survivor benefit.

The effect of remarriage on survivor benefits for widowed and divorced spouses.

How to amend your current benefits election if you made a mistake.

Limited Seating Available

Here's What You'll Learn

At SOFA, we believe if something’s worth doing, it’s worth doing right. When it comes to the nuances of Social Security, learning how to optimize your Social Security benefits goes a long way to helping you live comfortably and confidently.

This 90-minute master class offers real world strategies for those who are preparing for retirement and want to learn how to optimize their Social Security benefits and make their personal savings last.

One of the most important decisions you will be required to make before you retire is when and how to claim Social Security benefits. The majority of retirees apply for benefits as soon as they become eligible, at age 62. For many however, they do so without realizing they are significantly and permanently reducing the benefit amounts they and their spouse will receive throughout their lifetime.

Whether you’re single, married, divorced or widowed, there may be ways to optimize the amount of lifetime, after-tax benefits you and your family receive from Social Security. To do so successfully requires a keen understanding of the Social Security retirement system and the critical issues outlined below:

- How married couples can coordinate benefits to help enhance spousal and survivor benefits.

- How working after filing for benefits can eliminate eligibility to receive a benefit payment before full retirement age and the taxability of your benefit check.

- How to structure social security to reduce taxes.

- How claiming worker benefits early could permanently lower your spousal benefit at full retirement age.

- Ways to avoid the dozens of planning traps buried in the nearly 3,000 filing rules of the Social Security retirement system.

- How to claim a spousal benefit while earning delayed retirement credits on your own benefit.

Limited Seating Available

Here's Our Course Syllabus

Understanding Your Options

- Single, Spouse, Divorce Spouse and Widow benefits.

- Pros & Cons of filing before and after your full retirement age.

Maximizing your Benefits

- We compare and contrast two case studies to illustrate the benefits of social security optimization.

- Detailed cash flow summaries that explain and compare the two case strategies.

Case Study – Social Security Filing Strategies

- Whether you have a financial advisor or do it yourself, we’ll share 5 steps you must take to secure a successful retirement.

- How to get the maximum results from this master class.

Social Security Basics

- How to set up an online Social Security user account and download your statement.

- Eligibility requirements

- Cost of Living Adjustments

- Impact of the “Earnings Test”

- How Delayed Retirement Credits can maximize your income and hedge against inflation.

Coordinating Social Security with Retirement Income Planning

- Learn how Social Security benefits are taxed

- Identify how working impacts Social Security benefit

- Examine various “reset” strategies or “do-over” plan

- Create a personal retirement income plan

“It’s no secret that Social Security can seem very complicated. Enroll in this free course to learn tips to boost your income, and how to avoid common mistakes.”

“It’s no secret that Social Security can seem very complicated. Enroll in this free course to learn tips to boost your income, and how to avoid common mistakes.”

Register Today!

Seating is limited, so please RSVP soon. Once the class is full, wait listing will be done on a first-come, first-serve basis.

Register Today!

Seating is limited, so please RSVP soon. Once the class is full, wait listing will be done on a first-come, first-serve basis.

Course Option

to Choose From

THURSDAY

Sign up for our seminar waitlist

6:15 PM

-

-

-

The Mosey Hotel

5195 Main Street

Williamsville, NY 14221

Seating is limited, so please RSVP soon. Once the class is full, wait listing will be done on first come, first serve basis. You can also register by calling (888) 603-5144

About The Presenter

All AFEC instructors have achieved the Certified in Social Security Claiming Strategies (CSSCS) designation and, as a result, are uniquely qualified in the science of comprehensive retirement income planning. In addition, our instructors have gone through extensive training with our AFEC leadership team and possess the knowledge, skill and experience required to present the complex course concepts and materials in an effective and retainable way. AFEC instructors are committed to our mission of improving the financial literacy of all Americans approaching retirement. Our students walk away with a high quality financial education, a stronger understanding of their finances, and the skills needed to make better financial decisions about their future and the role various planning strategies play in building and managing more fortified retirement income plans.

By submitting your registration, you agree to our Privacy Policy.