CDC Guidelines for prevention of Covid-19 transmission will be followed

"You Don't Know What You Don't Know"

10 Risks & Strategies For Preparing For And Living In Retirement

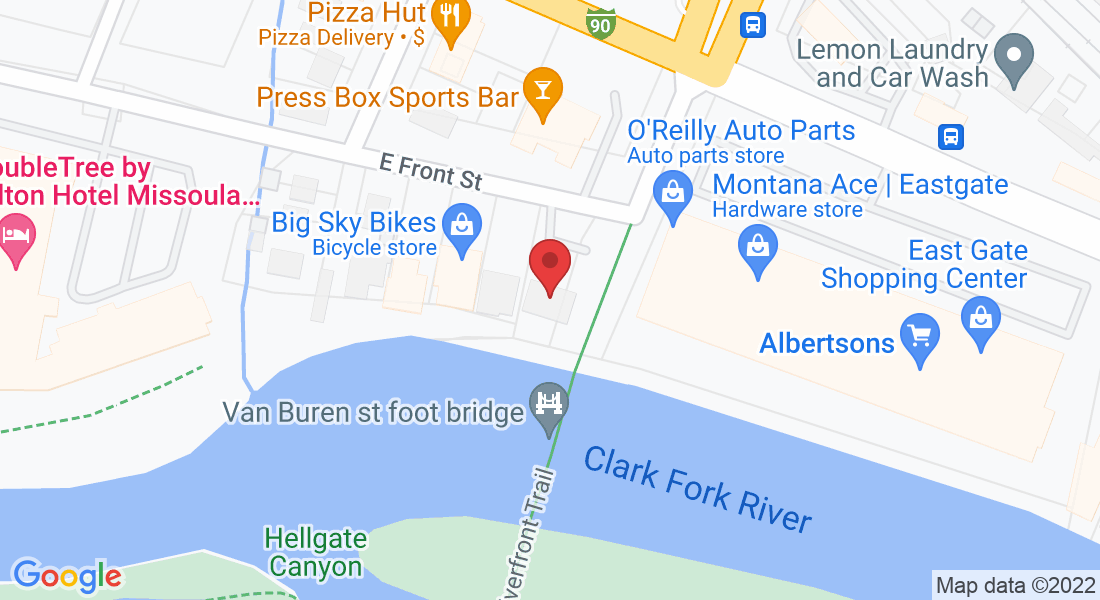

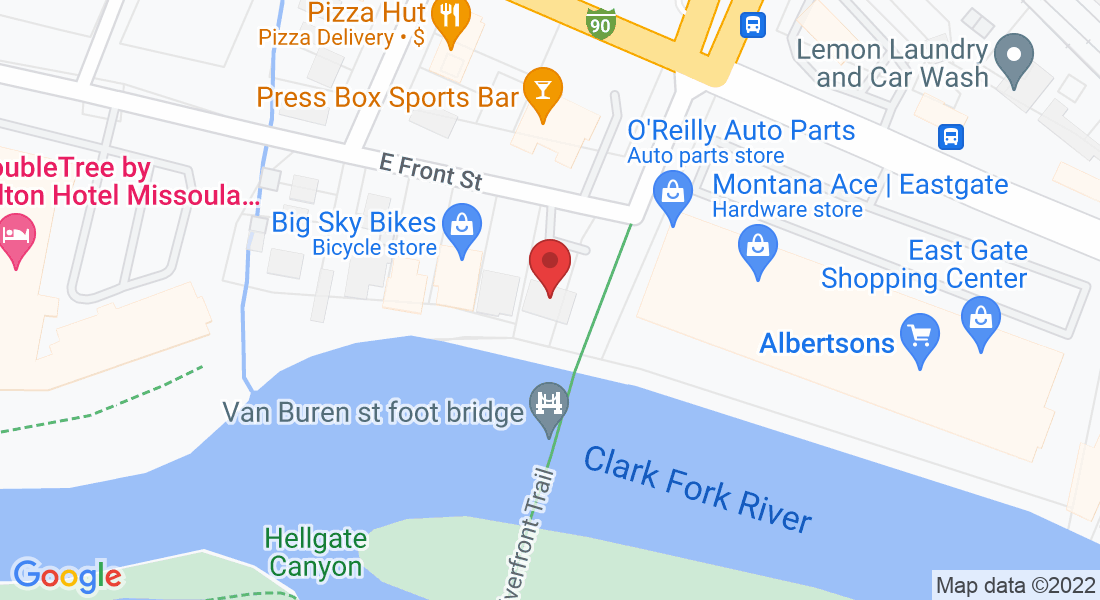

Offered at

, Missoula, MT 59802

6:30pm - 8:30pm

Hosted by SOFA USA, A Nationwide 501(c)3 Nonprofit since 1993

Instructor: Jamison R. Banna

Limited seating available

Register TODAY for a complimentary class to empower yourself with the knowledge to make better-informed decisions that impact you for your entire life.

"You Don't Know What You Don't Know"

10 RISKS & STRATEGIES FOR PREPARING FOR AND LIVING IN RETIREMENT

Offered At

, Missoula, MT 59802

Two Night Class

6:30pm - 8:30pm

Hosted by SOFA USA,

A Nationwide Non-Profit Since 1993

Instructor: Jamison R. Banna

Limited seating available

Register TODAY for a complimentary class to empower yourself with the knowledge to make better-informed decisions that impact you for your entire life.

Here's What You'll Learn

The statement "You Don't Know What, You Don't Know" is so true and daunting when considering how to ensure you do not out live your money "No Pressure".

So join us as this class will provide an in-depth look at 10 significant risks you may face and learn updated strategies that will help mitigate these risks. This class is beneficial if you are developing a retirement plan, nearing retirement or retired.

- Market Volatility Risk: Manage volatility in your assets & know your risk capacity

- Tax Rate Risks: Reduce the possibility of paying higher taxes in retirement

- Longevity Risk: Strategies to address outliving your money

- Inflation Risk: Manage the impact of a lifetime of increasing living & health care costs

- Tax-Efficiency: Evaluate the costs and benefits of tax-free strategies like Roth Conversions, Roth IRA, Roth 401k, etc.

- Social Security Risk: Take Social Security at the right time in the right way

- Social Security Tax Risk: Manage Social Security taxation

- Market Return Risk: Understand potential returns given your risk tolerance

- Long-Term Care Risk: Reduce the emotional and financial impact of Medicaid spend-down for long-term care on your family and money

- And More.....

Over 200 pages of class notes will be provided!

A common comment after attending this course, "Why does no one teach us these things?"

Join us and learn what questions you should be asking yourself, your spouse, your Accountants, Attorneys, Financial Advisors, Insurance Agents, and others who give you advice.

Our Course Syllabus

Section 1: Tax Law Updates Now & Beyond

On December 20, 2017, Congress passed the most significant federal tax reform law in more than 30 years. The "Tax Cuts and Jobs Act" (TCJA), the new law, means substantial changes for individual and business taxpayers. Many provisions in this tax reform sunset in 2025, and in 2026 the tax laws revert to 2017 tax laws. We will discuss some of the major provisions and how you may benefit from them.

We will also discuss the Secure Act which was signed into law on December 20, 2019, and effective January 1, 2020, as it has significant changes to retirement planning and strategies to address these changes.

Section 2: Retirement Planning

Retirement planning is consistently and rapidly evolving, and preparing and living in retirement requires a comprehensive knowledge of risks, strategies, and what questions you should be asking yourself. This section will explore what retirement might look like by giving you many things to consider so you can have the best retirement life possible.

Section 3: Social Security & Medicare

You will learn about Social Security and Medicare, and we will discuss strategies on when to take Social Security. In addition, you will learn about the impact of Social Security taxation on your retirement. We will also look at the IRS thresholds that cause Social Security taxation. Finally, we will discuss strategies you can implement that can put you in a position to receive your Social Security free from tax.

Section 4: Tax Rate Risk

The United States Government has made trillions of dollars in promises for programs like Social Security and Medicare it may not be able to keep- absent significant changes. Some experts have suggested that tax rates may rise to support these programs solvent, or benefits may need to be reduced. Like most Americans, you have saved the lion's share of your retirement in tax-deferred accounts like 401ks and IRAs. If tax rates go up, how much of your hard-earned money will you be able to keep? This section discusses strategies that you may want to consider to help insulate your assets from the impact of higher taxes.

Section 5: Retirement Distribution Planning

There is a lot of static in the media and on the internet about how to best save for retirement. In this section, you will learn about the three basic types of investment accounts and how to use them to maximize cash flow in retirement. Should you contribute to an IRA or a Roth IRA? How about Roth Conversions? This section teaches you how to position your savings to minimize taxes and maximize cash flow in retirement.

Section 6: Estate Planning

Estate planning involves more than just reducing your taxes. It's also about making sure your assets are distributed as you wish – both now and after you are gone. This section will discuss strategies and techniques to reduce or eliminate estate taxes, delays, and legal challenges following your death. You will also learn to build an estate plan that addresses your wishes should you have an incapacity due to an illness or injury. Finally, we will investigate the benefits of using a trust versus a will when determining how to best transfer your assets upon death. Please note that we are not legal professionals, and the information provided will be general, educational, and based on the instructor's experience. Most of us spend a lifetime trying to keep family together, and yet a poor estate plan can divide a family in a very short time. Estate planning is not about how much money you have but about your demise's impact on those you leave behind.

Section 7: Risk Management

The investment strategies that got you to this point may not necessarily be the ones that see you safely through retirement. This section discusses the many investment risks that affect investment portfolios and retirement. Strategies will be discussed that can help minimize the impact on your retirement plans. Some of these risks include market volatility risk, market return risk, inflation risk, and longevity risk.

Section 8: Retirement Distribution Risk

How much money can you safely take out of your retirement accounts without risking running out of money? Does the order in which you withdraw your various assets in retirement matter? What happens if you experience market loss while taking distributions? This section discusses these retirement risks and outlines strategies and solutions designed to create more consistency in your retirement plan.

Section 9: Long-Term Care Planning

In this section, we will cover the Medicaid rules that govern asset spend-down in the event you should need long-term care. Then we will cover the four most common strategies used to mitigate long-term care risk. Finally, we will help you assess which long-term care planning strategy is best suited to your particular situation.

And More.....

Here's What You'll Learn

The statement "You Don't Know What, You Don't Know" is so true and daunting when considering how to ensure you do not out live your money "No Pressure".

So join us as this class will provide an in-depth look at 10 significant risks you may face and learn updated strategies that will help mitigate these risks. This class is beneficial if you are developing a retirement plan, nearing retirement or retired.

- Market Volatility Risk: Reduce volatility in your assets & know your risk capacity

- Tax Rate Risks: Reduce the possibility of paying higher taxes in retirement

- Longevity Risk: Minimize outliving your money

- Inflation Risk: Reduce the impact of a lifetime of increasing living & health care costs

- Tax-Efficiency: Evaluate the costs and benefits of tax-free strategies like Roth Conversions, Roth IRA, Roth 401k, etc.

- Social Security Risk: Take Social Security at the right time in the right way

- Social Security Tax Risk: Reduce how much Social Security is taxed

- Market Return Risk: Understand potential returns given your risk tolerance

- Long-Term Care Risk: Reduce the emotional and financial impact of Medicaid spend-down for long-term care on your family and money

- And More.....

Over 200 pages of class notes will be provided!

A common comment after attending this course, "Why does no one teach us these things?"

Join us and learn what questions you should be asking yourself, your spouse, your Accountants, Attorneys, Financial Advisors, Insurance Agents, and others who give you advice.

Our Course Syllabus

Section 1: Tax Law Updates Now & Beyond

On December 20, 2017, Congress passed the most significant federal tax reform law in more than 30 years. The "Tax Cuts and Jobs Act" (TCJA), the new law, means substantial changes for individual and business taxpayers. Many provisions in this tax reform sunset in 2025, and in 2026 the tax laws revert to 2017 tax laws. We will discuss some of the major provisions and how you may benefit from them.

We will also discuss the Secure Act which was signed into law on December 20, 2019, and effective January 1, 2020, as it has significant changes to retirement planning and strategies to address these changes.

Section 2: Retirement Planning

Retirement planning is consistently and rapidly evolving, and preparing and living in retirement requires a comprehensive knowledge of risks, strategies, and what questions you should be asking yourself. This section will explore what retirement might look like by giving you many things to consider so you can have the best retirement life possible.

Section 3: Social Security & Medicare

You will learn about Social Security and Medicare, and we will discuss strategies on when to take Social Security. In addition, you will learn about the impact of Social Security taxation on your retirement. We will also look at the IRS thresholds that cause Social Security taxation. Finally, we will discuss strategies you can implement that can put you in a position to receive your Social Security free from tax.

Section 4: Tax Rate Risk

The United States Government has made trillions of dollars in promises for programs like Social Security and Medicare it may not be able to keep- absent significant changes. Some experts have suggested that tax rates may rise to support these programs solvent, or benefits may need to be reduced. Like most Americans, you have saved the lion's share of your retirement in tax-deferred accounts like 401ks and IRAs. If tax rates go up, how much of your hard-earned money will you be able to keep? This section discusses strategies that you may want to consider to help insulate your assets from the impact of higher taxes.

Section 5: Retirement Distribution Planning

There is a lot of static in the media and on the internet about how to best save for retirement. In this section, you will learn about the three basic types of investment accounts and how to use them to maximize cash flow in retirement. Should you contribute to an IRA or a Roth IRA? How about Roth Conversions? This section teaches you how to position your savings to minimize taxes and maximize cash flow in retirement.

Section 6: Estate Planning

Estate planning involves more than just reducing your taxes. It's also about making sure your assets are distributed as you wish – both now and after you are gone. This section will discuss strategies and techniques to reduce or eliminate estate taxes, delays, and legal challenges following your death. You will also learn to build an estate plan that addresses your wishes should you have an incapacity due to an illness or injury. Finally, we will investigate the benefits of using a trust versus a will when determining how to best transfer your assets upon death. Please note that we are not legal professionals, and the information provided will be general, educational, and based on the instructor's experience. Most of us spend a lifetime trying to keep family together, and yet a poor estate plan can divide a family in a very short time. Estate planning is not about how much money you have but about your demise's impact on those you leave behind.

Section 7: Risk Management

The investment strategies that got you to this point may not necessarily be the ones that see you safely through retirement. This section discusses the many investment risks that affect investment portfolios and retirement. Strategies will be discussed that can help minimize the impact on your retirement plans. Some of these risks include market volatility risk, market return risk, inflation risk, and longevity risk.

Section 8: Retirement Distribution Risk

How much money can you safely take out of your retirement accounts without risking running out of money? Does the order in which you withdraw your various assets in retirement matter? What happens if you experience market loss while taking distributions? This section discusses these retirement risks and outlines strategies and solutions designed to create more consistency in your retirement plan.

Section 9: Long-Term Care Planning

In this section, we will cover the Medicaid rules that govern asset spend-down in the event you should need long-term care. Then we will cover the four most common strategies used to mitigate long-term care risk. Finally, we will help you assess which long-term care planning strategy is best suited to your particular situation.

And More....

Register Today!

Seating is limited, so please RSVP soon. Once the class is full, wait listing will be done on a first-come, first-serve basis.

Upcoming Events

Join us for an educational workshop discussing 10 major risks (including taxes) you may face while living and preparing for retirement and strategies to help mitigate them. Workshop material will be provided. something like this. Over 200 pages of class notes and lunch will be provided!

Wednesday

DATE/TIME

6:30pm - 8:30pm

Seating is limited, so please RSVP soon.

Once the class is full, wait listing will be done on first come, first serve basis.

If you have any questions please call our office at (406) 549-2200.

COURSE INSTRUCTOR

Jamison R. Banna

https://storage.googleapis.com/msgsndr/z9pt1xfrriuBpEb6q5lh/media/624c90635dbe58cd6fb4baae.jpeg

The Society For Financial Awareness

3914 Murphy Canyon Road Ste A125

San Diego, CA 92123

Two Part Course To Attend

Join us for a two-night course of 3 hours each night 6:00 pm to 9:00 pm workshop discussing 10 major risks (including taxes) you may face while living and preparing for retirement and strategies to help mitigate them. Workshop material will be provided. something like this. Over 200 pages of class notes will be provided!

REGISTRATION CLOSED

Wednesday

DATE/TIME

6:30pm - 8:30pm

Seating is limited,

so please RSVP soon.

Once the class is full, wait listing will be done on first come, first served basis.

If you have any questions please call our office at (406) 549-2200.

COURSE INSTRUCTOR

Jamison R. Banna

The Society For Financial Awareness

3914 Murphy Canyon Road Ste A125

San Diego, CA 92123

This course is offered by The Society For Financial Awareness. SOFA the organization, does not offer to sell Financial Products nor promote any one particular company. Though the presenter may mention specific Financial Instruments and their functionality, SOFA's role is only to educate and inspire. SOFA only represents the educational workshop - all other endorsements are non-SOFA related.

Most financial advisors do not provide specific tax/legal advice, and the information presented at this seminar should not be considered as such. You should always consult your tax/legal advisor regarding your specific tax/legal situation.

Jamison R. Banna offers Securities through Cape Securities, Inc., member FINRA/SIPC/MSRB, and Investment Advisory Services offered through Cape Investment Advisory, an SEC Registered Investment Advisor. Glacier Wealth Management, Inc. is not affiliated with Cape Securities, Inc or Cape Investment Advisory, Inc.

This course is offered by The Society For Financial Awareness. SOFA the organization, does not offer to sell Financial Products nor promote any one particular company. Though the presenter may mention specific Financial Instruments and their functionality, SOFA's role is only to educate and inspire. SOFA only represents the educational workshop - all other endorsements are non-SOFA related.

Jamison R. Banna offers Securities through Cape Securities, Inc., member FINRA/SIPC/MSRB, and Investment Advisory Services offered through Cape Investment Advisory, an SEC Registered Investment Advisor. Glacier Wealth Management, Inc. is not affiliated with Cape Securities, Inc or Cape Investment Advisory, Inc.

Most financial advisors do not provide specific tax/legal advice, and the information presented at this seminar should not be considered as such. You should always consult your tax/legal advisor regarding your specific tax/legal situation.